Understanding the Various Levels of Auto Insurance Coverage

Unlocking Financial Savings: Your Ultimate Guide to Economical Automobile Insurance Coverage

Navigating the landscape of car insurance policy can commonly feel overwhelming, yet understanding the crucial parts can unlock substantial cost savings. Elements such as your driving history, automobile type, and insurance coverage choices play a pivotal duty in identifying your premium costs. By tactically approaching these elements and contrasting numerous providers, one can reveal considerable price cuts. However, the process does not finish with just selecting a policy; instead, it demands continuous evaluation and notified decision-making to make certain ideal security and price. What actions can you require to maximize your cost savings while preserving the required insurance coverage?

Recognizing Auto Insurance Policy Basics

Understanding the principles of vehicle insurance coverage is essential for any kind of vehicle proprietor. Auto insurance coverage acts as a safety step versus financial loss arising from accidents, burglary, or damages to your car. It is not just a lawful demand in a lot of territories but likewise a sensible investment to safeguard your possessions and well-being.

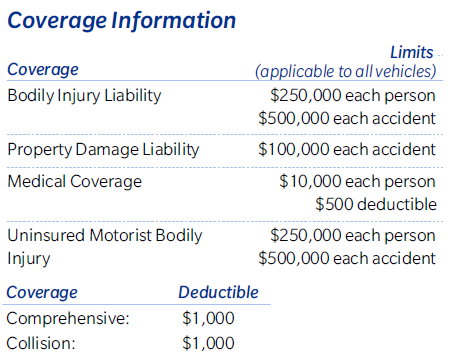

At its core, car insurance policy usually contains several crucial parts, including responsibility protection, collision coverage, and detailed protection. Liability coverage protects you against cases developing from problems or injuries you trigger to others in an accident. Crash protection, on the various other hand, covers problems to your lorry resulting from a collision with an additional car or things, while detailed insurance coverage safeguards versus non-collision-related cases, such as burglary or all-natural calamities.

Additionally, understanding policy limitations and deductibles is vital. Plan restrictions establish the optimum amount your insurance company will pay in case of a claim, while deductibles are the amount you will pay out-of-pocket before your insurance policy begins. Familiarizing yourself with these ideas can empower you to make enlightened choices, ensuring you pick the ideal insurance coverage to satisfy your requirements while preserving cost.

Variables Influencing Costs Expenses

Several aspects dramatically influence the cost of vehicle insurance coverage premiums, influencing the overall price of protection. One of the primary determinants is the driver's age and driving experience, as more youthful, less skilled motorists normally face higher premiums because of their increased danger profile. Furthermore, the kind of car insured plays an important duty; high-performance or luxury vehicles often incur greater expenses as a result of their fixing and replacement costs.

Geographical place is one more crucial aspect, with city areas usually experiencing greater costs compared to rural regions, mainly because of raised traffic and accident rates. The motorist's credit score history and claims history can also affect costs; those with a poor credit history score or a background of regular cases might be charged greater rates.

In addition, the degree of protection chosen, consisting of deductibles and policy limits, can affect premium prices substantially. Lastly, the objective of the car, whether for personal usage, commuting, or service, might additionally dictate costs variants. When seeking inexpensive car insurance policy., understanding these variables can aid customers make educated decisions (auto insurance).

Tips for Lowering Premiums

Minimizing vehicle insurance policy premiums is possible with a selection of critical techniques. One reliable approach is to raise your insurance deductible. By choosing a greater deductible, you can decrease your costs, though it's vital to ensure you can comfortably cover this amount in the event of an insurance claim.

Using available discount rates can additionally minimize expenses. Many insurance providers supply discounts for safe driving, packing plans, or having specific safety and security attributes in your vehicle. It's smart to ask about these choices.

One more technique is to examine your credit rating, as many insurer factor this right into costs estimations. Improving your credit report can lead to far better rates.

Lastly, consider enlisting in browse this site a vehicle driver safety and security training course. Finishing such programs typically certifies you for premium discount rates, showcasing your dedication to secure driving. By carrying out these approaches, you can successfully lower your auto insurance policy premiums while Continue keeping adequate insurance coverage.

Contrasting Insurance Coverage Carriers

When seeking to lower vehicle insurance prices, contrasting insurance policy service providers is an important action in locating the very best insurance coverage at an affordable cost. Each insurance provider offers distinct policies, protection choices, and prices structures, which can substantially affect your overall expenses.

To begin, collect quotes from several carriers, guaranteeing you preserve regular insurance coverage levels for an exact contrast. Look past the premium costs; scrutinize the specifics of each plan, consisting of deductibles, responsibility limits, and any type of extra functions such as roadside support or rental automobile insurance coverage. Understanding these components will assist you determine the value of each policy.

In addition, think about the online reputation and customer care of each supplier. Study online evaluations and scores to assess consumer satisfaction and claims-handling performance. A provider with a strong record in solution might deserve a somewhat greater premium.

When to Reassess Your Policy

Frequently reassessing your vehicle insurance policy is essential for guaranteeing that you are obtaining the best coverage for your demands and budget. A number of essential life occasions and modifications necessitate a review of your plan. For instance, if you relocate to a brand-new address, specifically to a different state, neighborhood regulations and danger factors might influence your premiums. Furthermore, getting a brand-new lorry or marketing one can modify your insurance coverage requirements.

Adjustments in your driving habits, such as a new task with a much longer commute, need to also trigger a review. Substantial life events, consisting of marriage or the article source birth of a kid, might require extra insurance coverage or modifications to existing policies.

Final Thought

Accomplishing cost savings on auto insurance necessitates a comprehensive understanding of insurance coverage requirements and premium influencing factors. Via attentive comparison of quotes, assessment of driving records, and evaluation of vehicle safety attributes, people can reveal possible discounts. In addition, techniques such as boosting deductibles and on a regular basis reviewing plans add to reduce premiums. Continuing to be educated and proactive in evaluating choices ultimately guarantees access to budget-friendly auto insurance coverage while preserving sufficient protection for properties.

At its core, auto insurance coverage usually is composed of a number of crucial parts, consisting of obligation insurance coverage, collision coverage, and extensive insurance coverage.Several variables substantially affect the expense of auto insurance coverage premiums, affecting the overall price of protection. By executing these strategies, you can effectively reduce your auto insurance costs while preserving sufficient insurance coverage.

Frequently reassessing your automobile insurance coverage policy is critical for ensuring that you are receiving the ideal protection for your needs and budget plan.Attaining cost savings on car insurance requires a comprehensive understanding of insurance coverage demands and premium influencing elements.